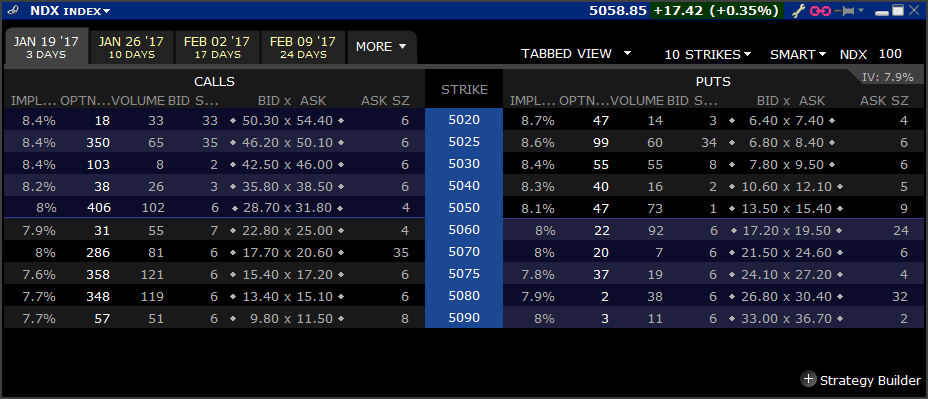

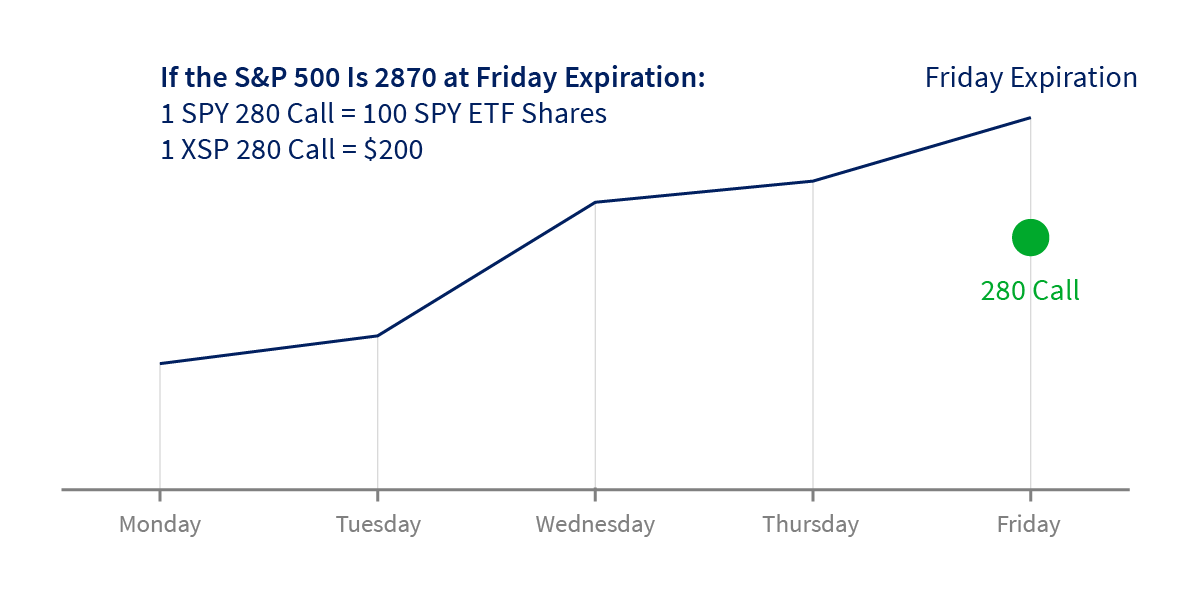

All else equal, why are S&P 500 index (SPX) options with lower strike prices more expensive (have higher implied volatilities) than higher strike prices? - Quora

All Option strategies failed strategies? - General - Trading Q&A by Zerodha - All your queries on trading and markets answered

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)