Scrap the Cap: Strengthening Social Security for Future Generations – Social Security Works – Washington

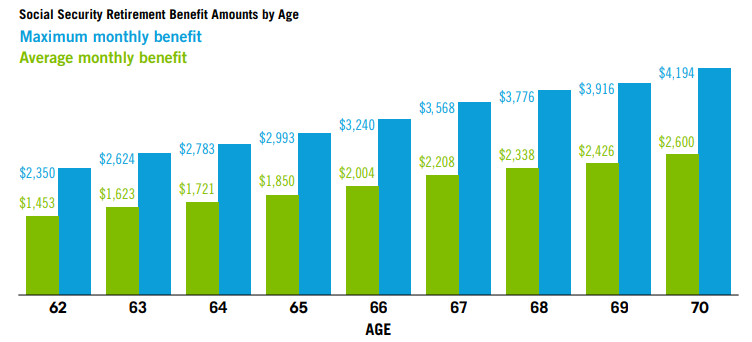

The Social Security Retirement Benefit – A Key Component of Retirement Planning | Affiance Financial

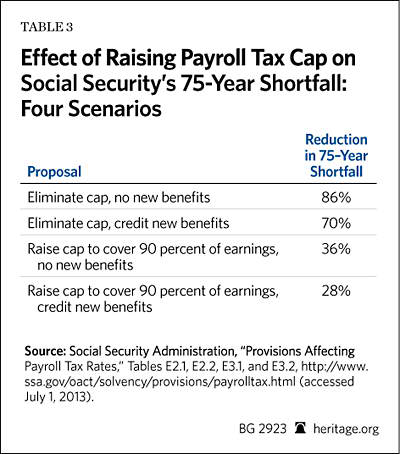

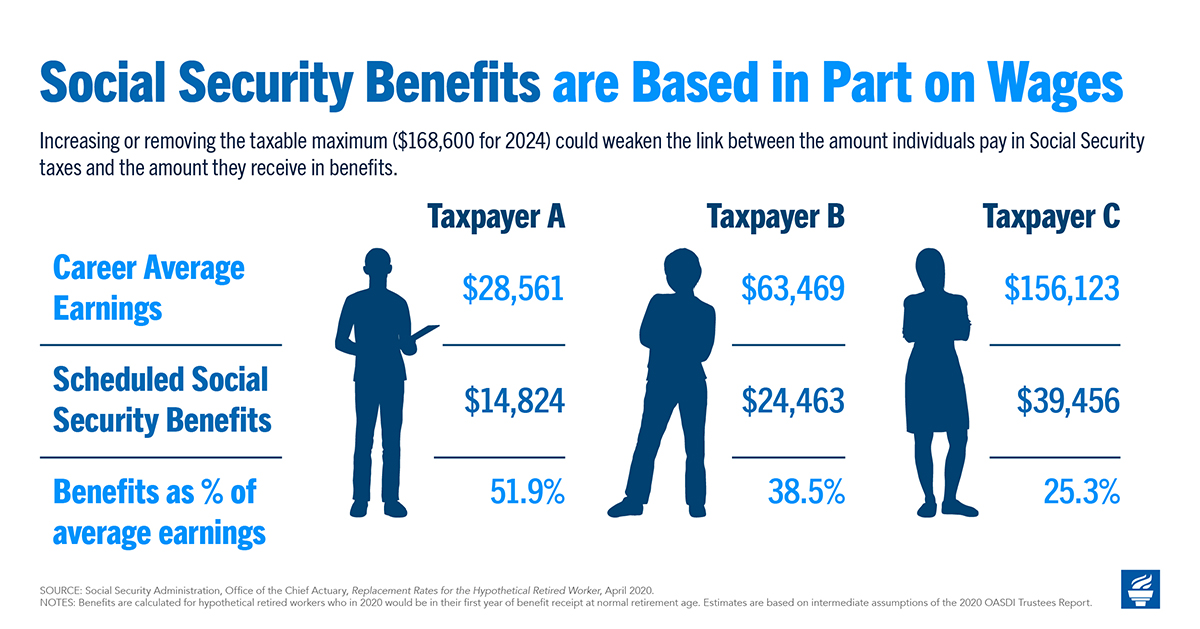

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

:max_bytes(150000):strip_icc()/GettyImages-184127461-e960f1b3d8964e9ca317e4640e208ab2.jpg)